British companies are not taking advantage of households by using double-digit inflation as cover for unnecessary price increases to boost their profits, according to analysis by a former Bank of England rate setter.

Article content

(Bloomberg) — British companies are not taking advantage of households by using double-digit inflation as cover for unnecessary price increases to boost their profits, according to analysis by a former Bank of England rate setter.

Advertisement 2

Article content

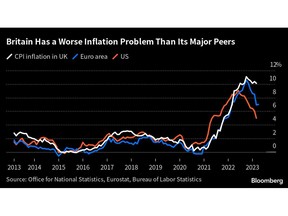

Michael Saunders, a senior economic adviser at Oxford Economics, said that the UK is not suffering from so-called “greedflation,” contrary to claims by politicians and evidence from the US and euro zone suggesting that firms there are squeezing consumers more than needed in a cost-of-living crisis.

Article content

Politicians in the UK have accused supermarkets of profiteering after grocery inflation hit the highest rate in more than 45 years.

Saunders, a member of the Monetary Policy Committee between 2016 and 2022, found that profit margins in the manufacturing and services sectors have slipped below the long-run average. A recent escalation in food inflation is likely to be due to the “usual lags rather than profiteering.”

Article content

Advertisement 3

Article content

“Take out oil and gas, where profits have risen sharply, and the share of company profits in GDP has fallen markedly,” Saunders said in a note to clients. “Sure, it’s possible to find individual cases of widening corporate profits, but these do not reflect the overall picture in our view.”

He warned that the squeeze on companies could drag on the economy as it is likely to prompt them to cut investment and jobs.

The analysis shows that the profits of non-financial companies have increased slightly as a share of GDP, albeit only to levels seen regularly throughout the 2010s. However, when excluding oil and gas firms, corporate profits as a share of the economy have fallen to near record lows.

Saunders also brushed aside concerns about greedflation in the grocery sector after Liberal Democrat leader Ed Davey called on the competition watchdog to probe supermarkets and food giants. There have been concerns that a fall in agricultural commodity prices has not been passed back to consumers.

Advertisement 4

Article content

“The bulk of UK food price inflation reflects cost increases from the international surge in prices for agricultural commodities and energy, rather than higher profits among UK food manufacturers and retailers,” said Saunders. The difference in agricultural commodity prices and costs on supermarket shelves “probably reflects the usual lags rather than profiteering.”

The BOE is also sanguine over the prospect of widespread “greedflation” making its task of getting inflation back to its 2% target more difficult.

On Friday BOE chief economist Huw Pill said there had not been “big dramatic movements” in companies’ share of national income. Last week, Governor Andrew Bailey also said energy usage in food production and companies’ hedging strategies are partly to blame for elevated food price inflation.

Saunders’s analysis also suggests that UK firms are reacting differently to the inflation surge than their counterparts in the euro zone and the US where evidence has emerged of inflation being partly fueled by companies widening profit margins.

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation